The State Claims Agency has completed an analysis of a sample of workplace employee injury claims taken against a range of State authorities.

The Enterprise Risk Management Unit carried out the study to establish a robust tool for estimating the true cost of workplace employee injury claims to assist State authorities to make vital budgetary and management decisions to mitigate the risk of injuries and claims occurring.

The study analysed 30 workplace employee injury claims finalised before the Personal Injuries Guidelines came into effect in April 2021. The claims covered different incident types and injury types. The claimants were from various socio-demographic groups and represented a variety of work roles, including military/prison/police officers, agricultural inspectors, clerical officers, healthcare and social workers and supportive and assistant staff.

The findings highlighted the importance of investing in workplace employee safety.

What do we mean by ‘true costs’ of claims?

It is important to acknowledge that a workplace injury can have a devastating physical and/or psychological impact on an employee.

These costs are intangible but can be substantial and should never be ignored.

For managers and workplace health and safety practitioners, we know that workplace employee injury claims can also be a financial and management concern.

It is important to recognise that the ‘true costs’ of claims include both direct and indirect costs, for example:

- Direct claims costs: Paid damages, plaintiff legal costs, agency legal costs, expert costs

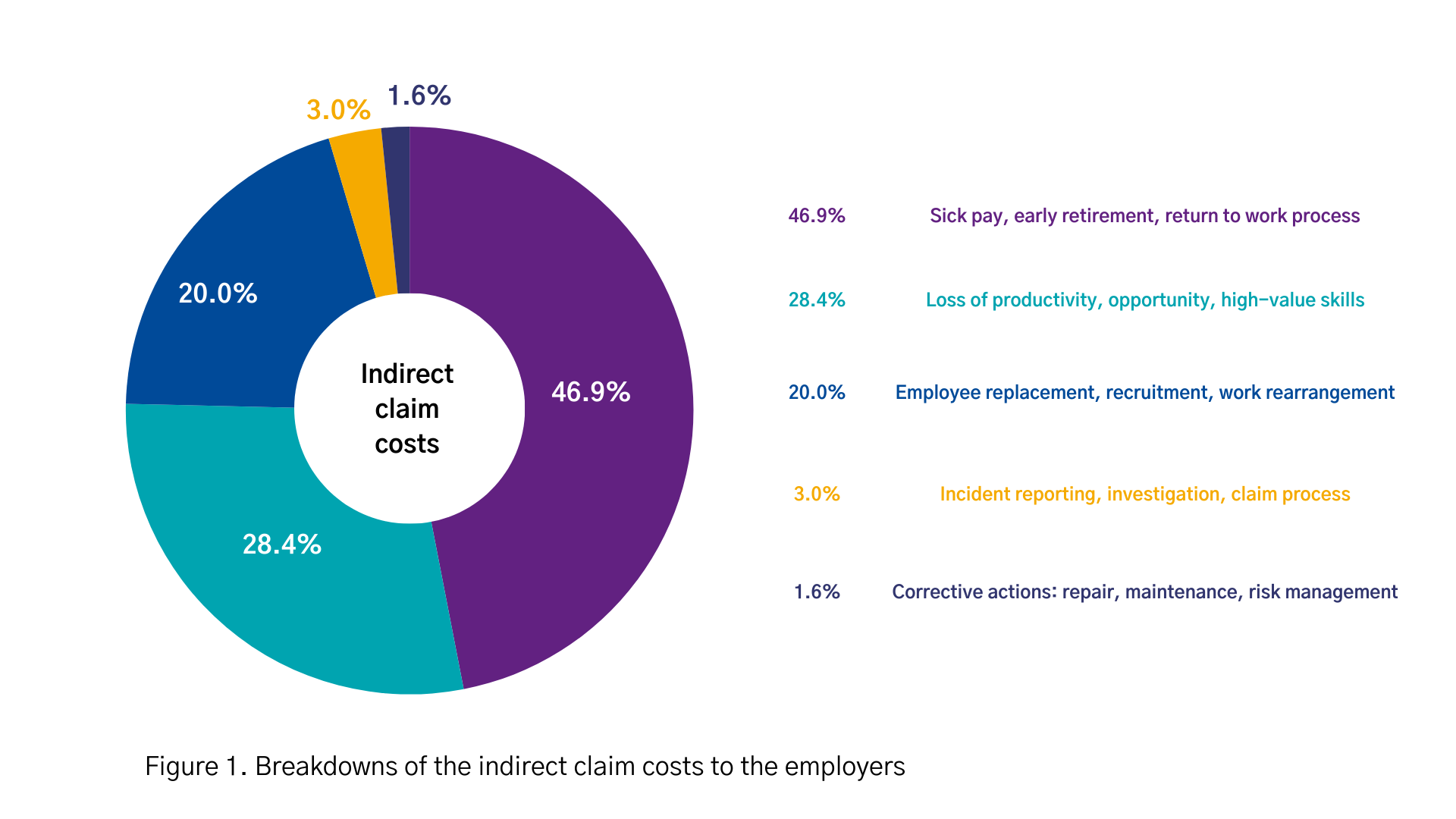

- Indirect claim costs: Loss of productivity/high value skills, sick pay/early retirement, employee replacement, employer time lost on handling incidents and claims, corrective actions (engineering controls and risk management activities)

What did our analysis find?

Based on our analysis of these claims, we found:

- Ratios of the indirect to direct claim costs varied from case to case. On average, for every one euro of direct claim cost paid out, the employer bears 80 cents to cover the indirect claim cost. Combing direct and indirect costs, the true claim cost is 1.8 times of the direct claim cost paid out.

- The true claim costs become higher if the incident resulted in employee long-term sick leave and psychological injuries. Compared to physical-only injuries, psychological injuries are more likely to result in long-term sick leave and resignation from the job.

- Most (95%) of the indirect claim costs were related to employee absences, such as sick pay and early retirement, loss of productivity/opportunity and high-value skills, and employee replacement (figure 1)

- Corrective actions accounted for merely 1.6% of the indirect claim costs to the employer. Examples of corrective actions include floor repair, replacement of equipment or furniture, adoption of new safety equipment, risk assessment of a hazard that had been overlooked, improvement of the existing risk control procedure, more inspections and additional training.

What does this mean for State authorities?

Based on the findings from the cost analysis, we provide the following key advice for employers:

- The cost ratio enables an organisation to visualise how much value is lost due to employee injuries which resulted in claims. This ratio can be used to predict the future cost and provide a sound financial basis for workplace safety-related investment decisions, such as allocating resources, optimising staffing levels or improving training programmes.

- Given that long-term sick leaves result in higher true claim costs, employers should take proactive interventions to ensure the length of sick leave is proportionate to the severity of the injury suffered. Line managers, the human resource department, and Chief Medical Officers (or occupational health officers) all have a role to play in assisting the injured employee to return to work, on many occasions on a phased approach.

- Psychological injuries can have a devastating impact on an employee’s career, and result in substantial costs to the employer. Employers should mitigate workplace psychological risks, and the starting point is risk assessment. The State Claims Agency and Health Safety Authority (HSA) have jointly developed psychological risks assessment guidance in relation to exposure to sensitive content, and Work Positive CI – a risk assessment and management tool focusing on work-related stress and critical incident management. Interventions to prevent and manage psychological risks can be implemented at three levels. The primary level focuses on eliminating the sources of psychological risks inherent in the work system and environment. The secondary level involves risk management for ‘at-risk’ groups or individuals and the common strategies include education and training. The tertiary level covers reactive strategies, such as employee assistance programmes and therapies.

- Corrective actions accounted for less than 2% of the indirect claim costs. If carried out as part of preventative maintenance and risk management programmes, they would have cost the same and prevented the incident. This highlights the importance of risk control measures – small, targeted investments can help organisations avoid significant costs.

Queries and support

For further assistance and support please contact our Enterprise Risk Management Unit at stateclaims@ntma.ie